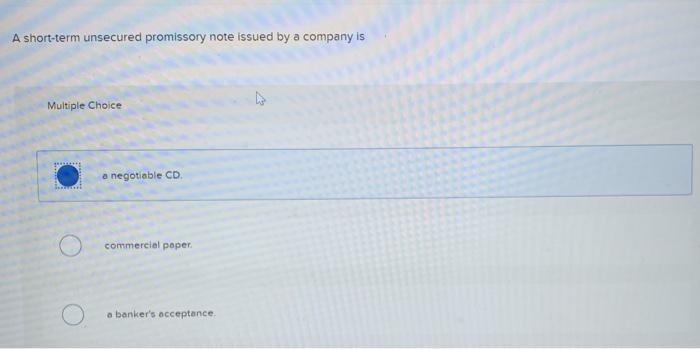

A Short-term Unsecured Promissory Note Issued by a Company Is

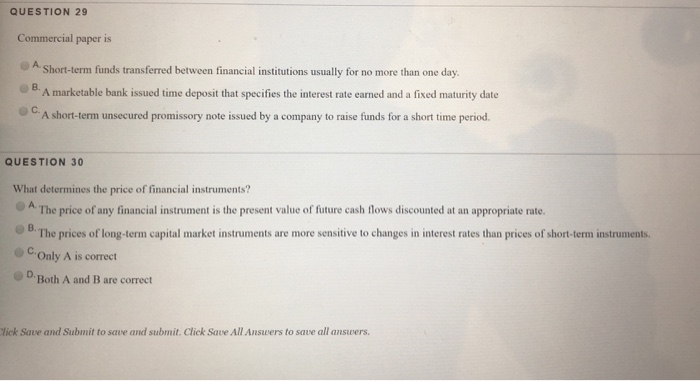

10 A negotiable CD is 1. Commercial paper is an unsecured short-term debt instrument issued by a corporation typically for the financing of accounts payable.

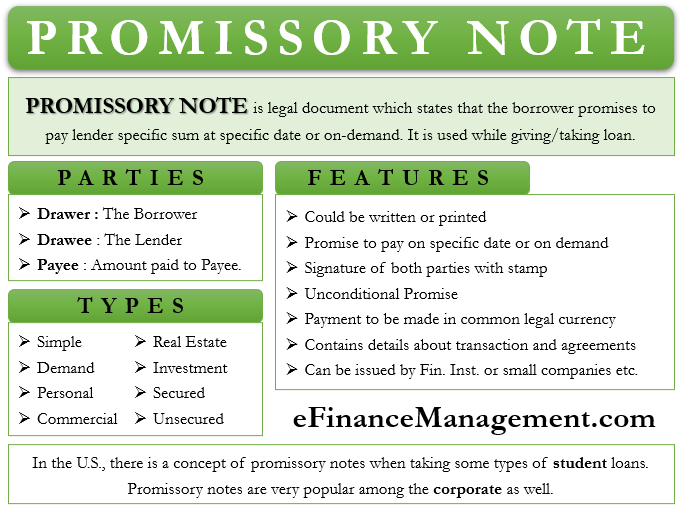

Promissory Note Definition Format Example How It Works

It is an instrument issued by large and creditworthy companies to raise short term funds at lower interest rates.

. A short-term unsecured promissory note issued by a company is a. Capital notes have low priority and carry more risk than other types of secured corporate debt. The issuer guarantees the buyer to pay a fixed amount in future in terms of liquid cash and no assets.

Is virtually always rated by at least one ratings agency. Loan to an individual or business to purchase a home land or other real property short-term fund transferred between financial institutions usually for no more than one day marketable bank-issued time deposit. Ad Create a Legally Binding Promissory Note to Confirm a Promise to Pay Back a Sum of Money.

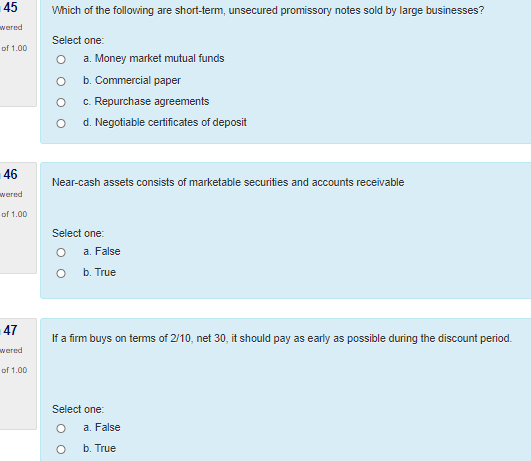

Commercial paper is a short-term usually unsecured promissory note issued by firms with strong credit ratings Commercial paper securities are unsecured promissory notes issued by corporations that mature in no more than 270 days Commercial paper is a short-term unsecured promissory note. A time draft payable to a seller of goods with payment guaranteed by a bank 2. Finance questions and answers.

A capital note is short-term unsecured debt issued by a company to pay short-term liabilities. A Treasury bill b Commercial paper c Certificate of deposit d Promissory note. Step-by-Step Instructions on All Devices.

Has no secondary market. Ad Write A Resignation Letters W Our Automated Form Builder. Answer C is correct.

Get Reliable Legal Forms Online. Create Legal Contracts Online. Short term unsecured promissory note issued by a company to raise funds for a short time period 6.

Commercial paper issued in the United States Multiple Choice is an unsecured short-term promissory note. ___ is a short-term unsecured promissory note issued by reputed business organisations at a price lower than its face value and redeemable at par. It is issued by large and creditworthy companies to raise short term funds at lower rates of interest than market rates.

Promissory notes issued by company for short term fund raising and are unsecured are classified as commercial paper. Financial institutions and large corporations are the main issuers of commercial paper because they have high credit ratings. There is no collateral backing for an unsecured promissory note.

There is trust in the market that they will repay unsecured promissory notes of this nature. Ad Create a Promissory Note to Document a Financial Promise Between Two Parties. A loan to an individual or business to purchase a home land or other real property 3.

Commercial paper is a short-term unsecured debt instrument with a duration of 1-270 days. Easy to Use Online Templates. Has a maximum maturity of 270 days.

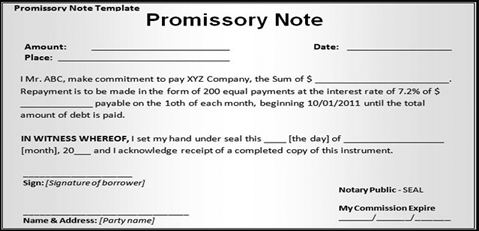

It acts as an evidence certificate of unsecured debt. The promissory notes issued by company for short term fund raising and are unsecured are classified as The maximum maturity days of holding commercial paper are If the 175 days T-bill have the maturity of one year with the value of 8000 USD and face value is 10000 USD then reported discount yield is. _____ is a short-term unsecured promissory note issued by reputed business organisations at a price lower than its face value and redeemable at par.

_____ is a short-term unsecured promissory note issued by reputed businessorganisations at a price lower than its face value and redeemable at par. Ad High-Quality Fill-in The Blanks Templates Created By Business Experts Lawyers. Commercial paper is the term for the short-term typically less than 9 months unsecured large denomination often over 100000 promissory notes.

Get Personalized Documents Within 5 Minutes. It is a short-term money market tool including a promissory note and a set maturity. It is a short-term unsecured promissory note which is negotiable and transferable by endorsement and delivery having a fixed maturity period.

Correct E A negotiable CD Multiple Choice. Fast Easy Simple Templates. Lenders who decide to use an unsecured promissory note should consider the credibility of the borrower before signing the agreement.

Using an unsecured promissory note means that the lender will not receive anything in return if the borrower is unable to make the required payment. A negotiable CD is a. Multiple Choice time draft payable to a seller of goods with payment guaranteed by a bank.

Ii Commercial Paper Commercial paper is a short term unsecured promissory note negotiable and transferable by endorsement and delivery with a fixed maturity period. The maturity period of commercial paper is from 15 days to one year. Hundreds Of Templates At Your Fingertips.

It is subscribed at a discount rate and can be issued in an interest-bearing application. Carries an interest rate above the prime rate.

Promissory Note Meaning Types Features And More

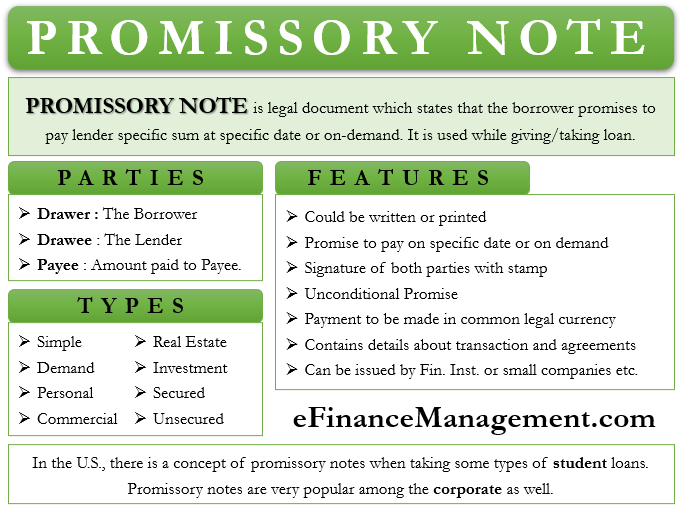

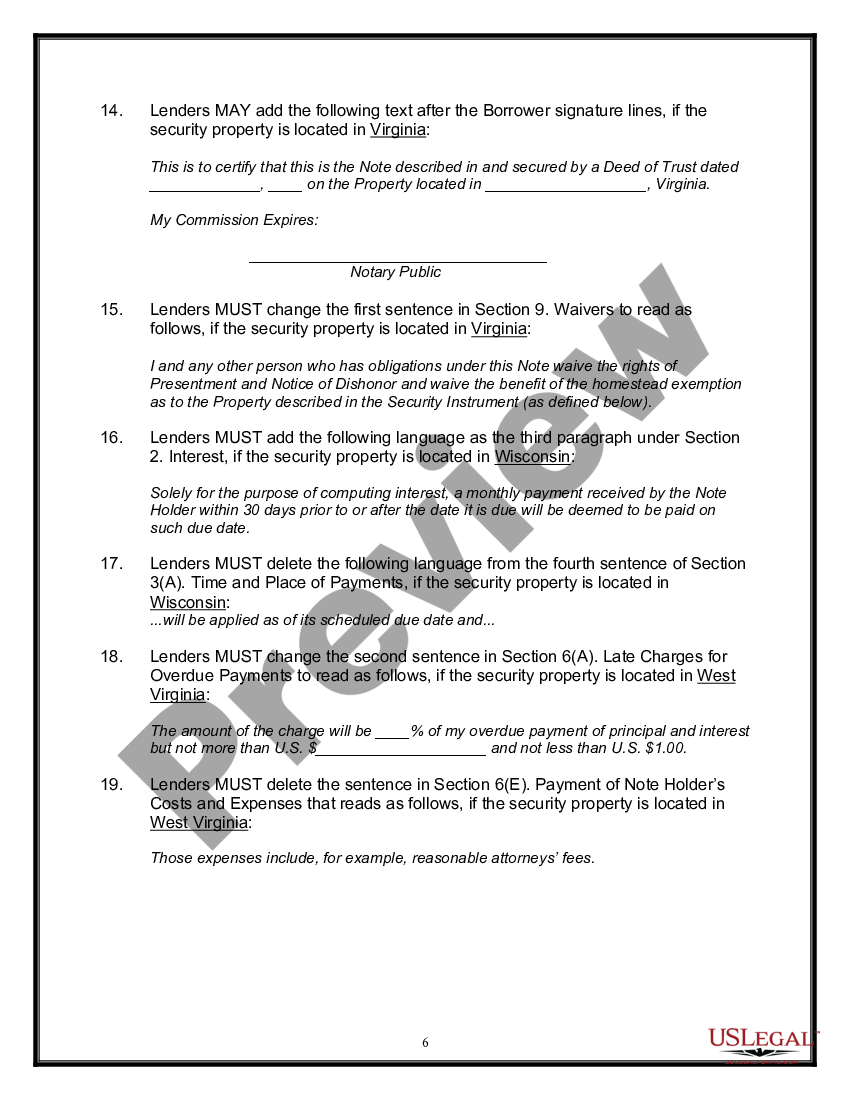

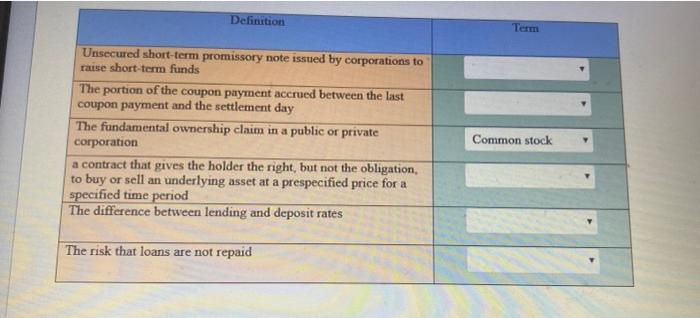

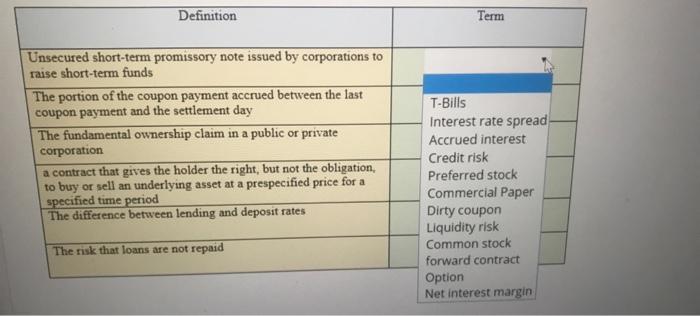

Solved Term Definition Unsecured Short Term Promissory Note Chegg Com

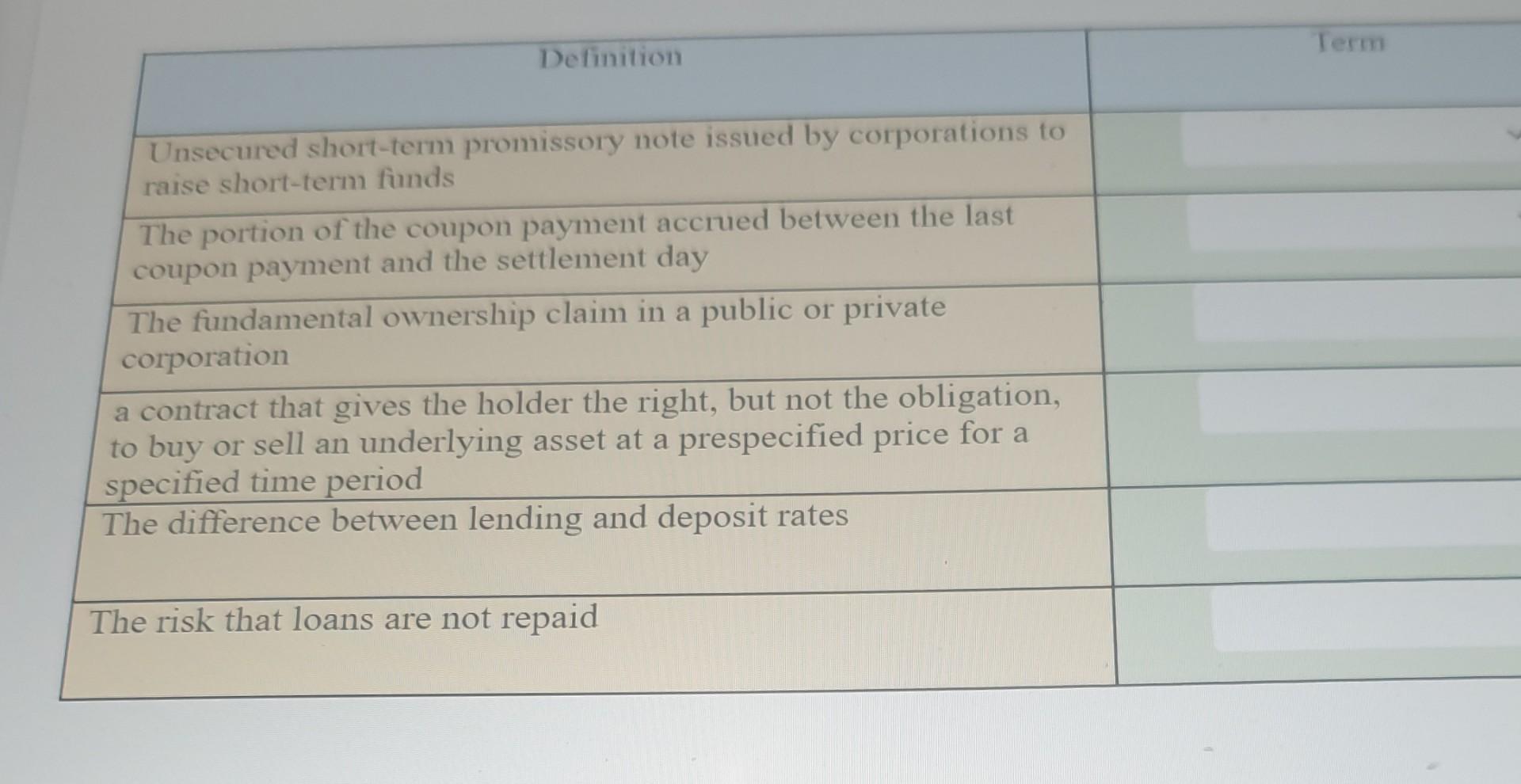

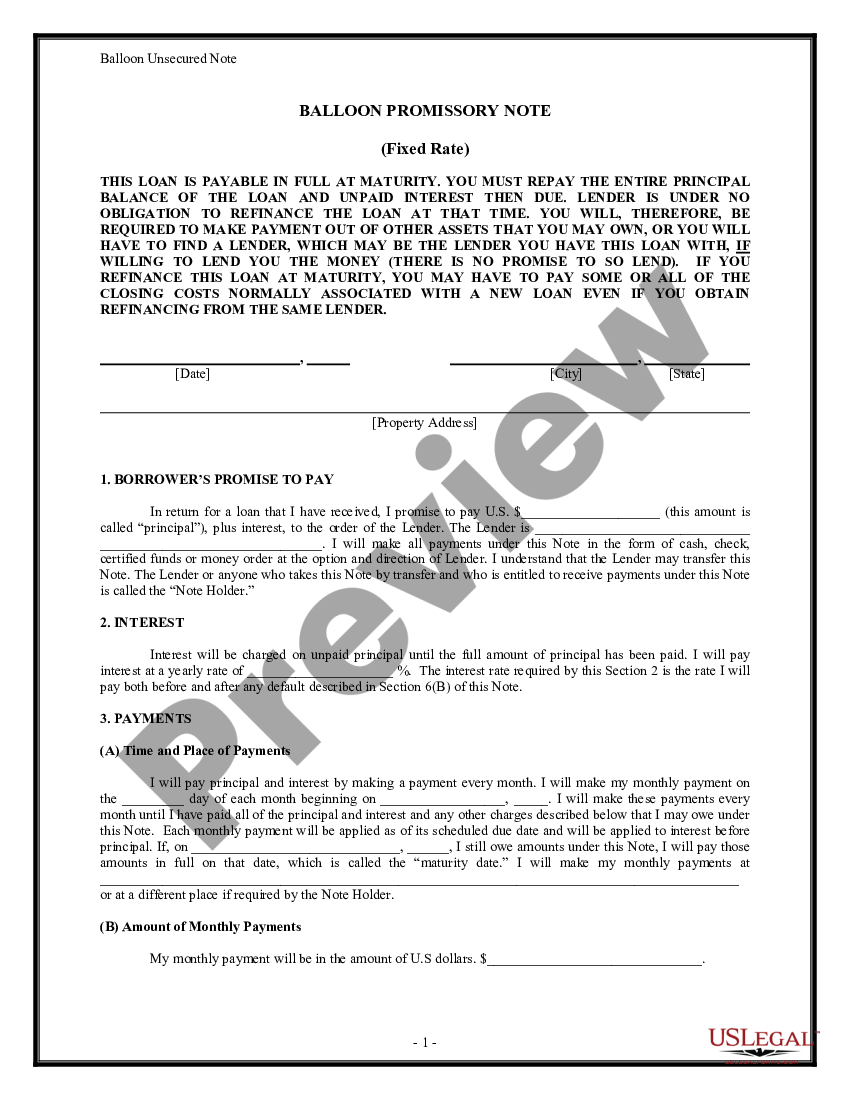

Balloon Unsecured Promissory Note Balloon Note Example Us Legal Forms

Solved Definition Term Unsecured Short Term Promissory Note Chegg Com

38 Free Promissory Note Templates Forms Word Pdf

Definition Of Promissory Note Chegg Com

Secured Promissory Note Vs Unsecured Promissory Note Legalzoom Com

Solved Definition Term Unsecured Short Term Promissory Note Chegg Com

Free Promissory Note Template Secured Unsecured Pdf

Solved Question 29 Commercial Paper Is A Short Term Funds Chegg Com

Promissory Note Definition Format Example How It Works

Balloon Unsecured Promissory Note Balloon Note Example Us Legal Forms

Solved A Short Term Unsecured Promissory Note Issued By A Chegg Com

Solved 45 Which Of The Following Are Short Term Unsecured Chegg Com

Promissory Notes Daniel Lenghea Pa

Balloon Unsecured Promissory Note Balloon Note Example Us Legal Forms

Comments

Post a Comment